The Problem with ESG

The issue with ESG is it is seen as a cost. ERM a lead environmental consultancy estimates major firms affected by Scope 1,2,3 and other ESG reporting requirements spend £533,000 a year on reporting (approx 0.1% of Turnover). Analysis of the ESG data collection methods shows a 2.47 increase in cost. This is predominantly absorbed by major firm's supply chain. In most regulated sectors, this increased cost is passed onto SMEs. This cost manifests itself as 1/5th of a FTE per year (approx 20% of Turnover) for an average SME.

AutoESG

AutoESG's aim, with partners, is to improve the way in which ESG reporters gather data, and to make the cost of compliance more equitable within their supply chain.

This is achieved by automatically gathering relevant and current data, and by enabling the supply of financial incentives for SMES in the ESG supply chain.

It is expected that reducing the effort of reporting will enable firms to focus on the more challenging features of ESG. For example, exploring mitigation techniques, and in the finance sector evidencing compliance to the FCA Consumer Duty.

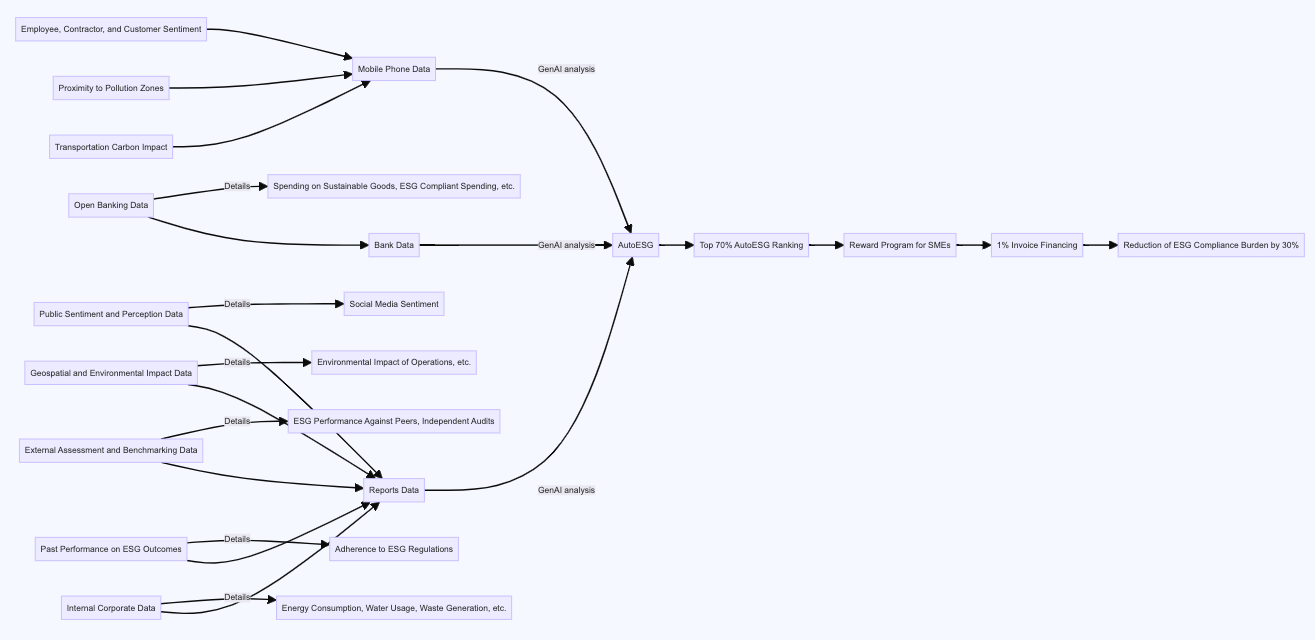

One example of inputs and outputs of AutoESG is summarised below:

This is achieved by automatically gathering relevant and current data, and by enabling the supply of financial incentives for SMES in the ESG supply chain.

It is expected that reducing the effort of reporting will enable firms to focus on the more challenging features of ESG. For example, exploring mitigation techniques, and in the finance sector evidencing compliance to the FCA Consumer Duty.

One example of inputs and outputs of AutoESG is summarised below:

AutoESG's ESG objectives:

- Give ESG reporters 14 hours a week back for mitigation activities. The impact of this per sector can be significant. For example in TV, Film and Media sector in wales this could release between 650 and 4000 days a year for 'Greening the Green' initiatives e.g. improving energy and water consumption, diesel usage, transport, generators, renewable energy sources, studio efficiency, facility improvements, transport modes, and catering.

- Supporting the cashflow of the SMES (who carry 85% of the ESG evidence burden) by enabling finance firms to provide better invoice financing rates for high performing AutoESG users.

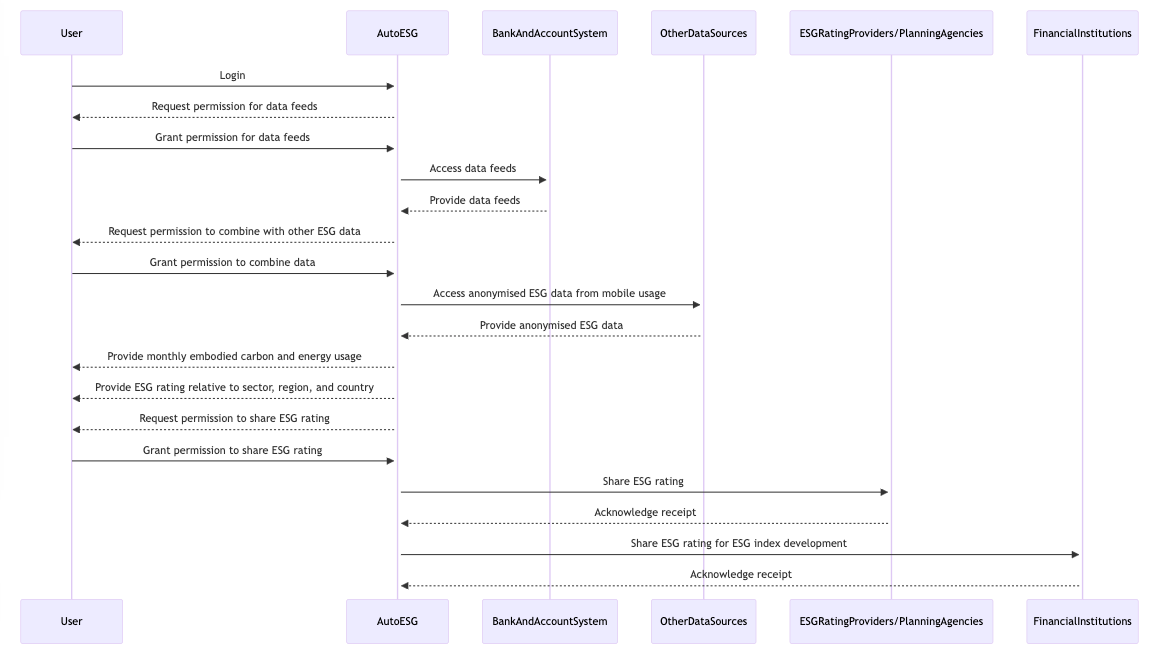

A summary of the current data flows associated with AutoESG are as follows: